Marketplace financial crime – how to avoid the risks

Marketplaces can find themselves particularly at risk of financial crime. What specifically can happen on a marketplace – and how to avoid it?

Published on

Last updated on

This is a guest post by Danielle Herndon, an experienced compliance professional in the payments and fintech industries.

Preventing financial crime is something all e-commerce firms need to be mindful of in today’s world. However, due to the way marketplaces operate, certain financial crime is particularly applicable to them. In this article, we discuss what can happen and how to best avoid it.

Financial crime represents a huge, multi-faceted challenge to our world today. A 2018 global report by Reuters estimated that $1.45 trillion worth of turnover is lost as the result of financial crime, and a PwC investigation found that 49% of firms had found themselves victim of it last year.

Clearly, financial crime is an issue that all firms must consider and prepare for. However, marketplaces can find themselves particularly susceptible to certain aspects of it. The very nature of the marketplace model means that they retain far less control over the sales process, as they are not directly selling their own goods or services. Yet customers expect the exact same level of security and customer experience as they would with any site—as they should.

In other words, as marketplaces are less involved in each individual sale, they must be even more vigilant when it comes to financial crime. Below, we outline some examples of more complex financial crime that are particularly relevant to marketplaces, and how they can best be prevented.

Transaction laundering, buyer-seller collusion, and advanced fee fraud are types of financial crime that might affect marketplace businesses. We’ll discuss each of them in more detail.

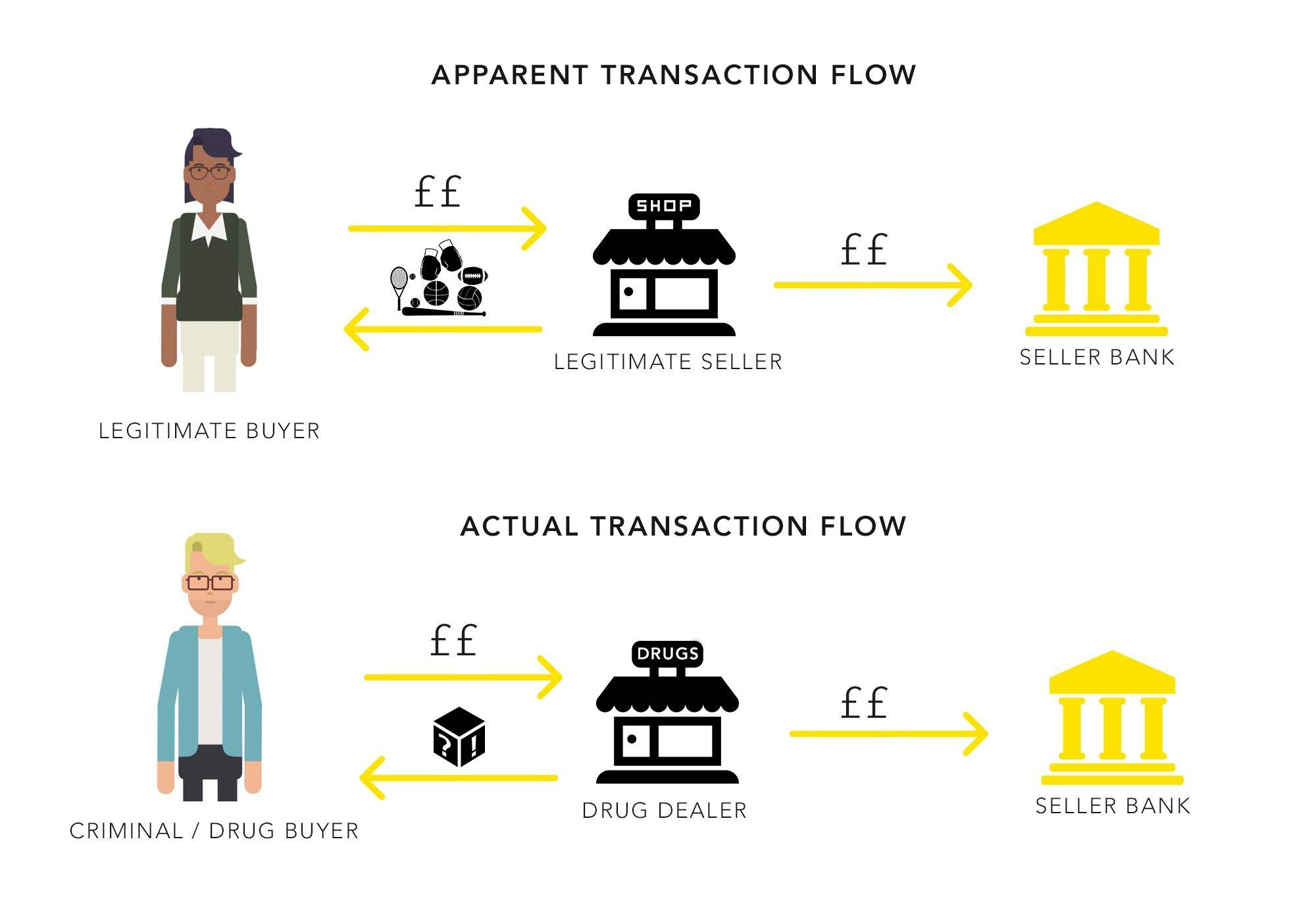

Transaction laundering is a specific type of money-laundering which involves ‘sellers’ using the internet to sell illegal goods, masquerading them as legitimate product sales.

An example of where this may be seen is on a product marketplace. A criminal lists items they do not own on the marketplace when they are in fact selling drugs. They share the link to their profile with their customers, and when a purchase is made, they send the drugs, often disguised as another item. If a user inadvertently attempts to buy an item, the criminal can tell them the item is no longer available without raising a great deal of suspicion.

Whilst criminals can transaction launder by setting up their own website, there are obvious advantages to using a marketplace. Firstly, it enables criminal activity to be blended in amongst similar transactions with a very quick set up time. Furthermore, the criminal knows that if their profile is attracting unwanted attention, they can always create another—or even switch to a different marketplace.

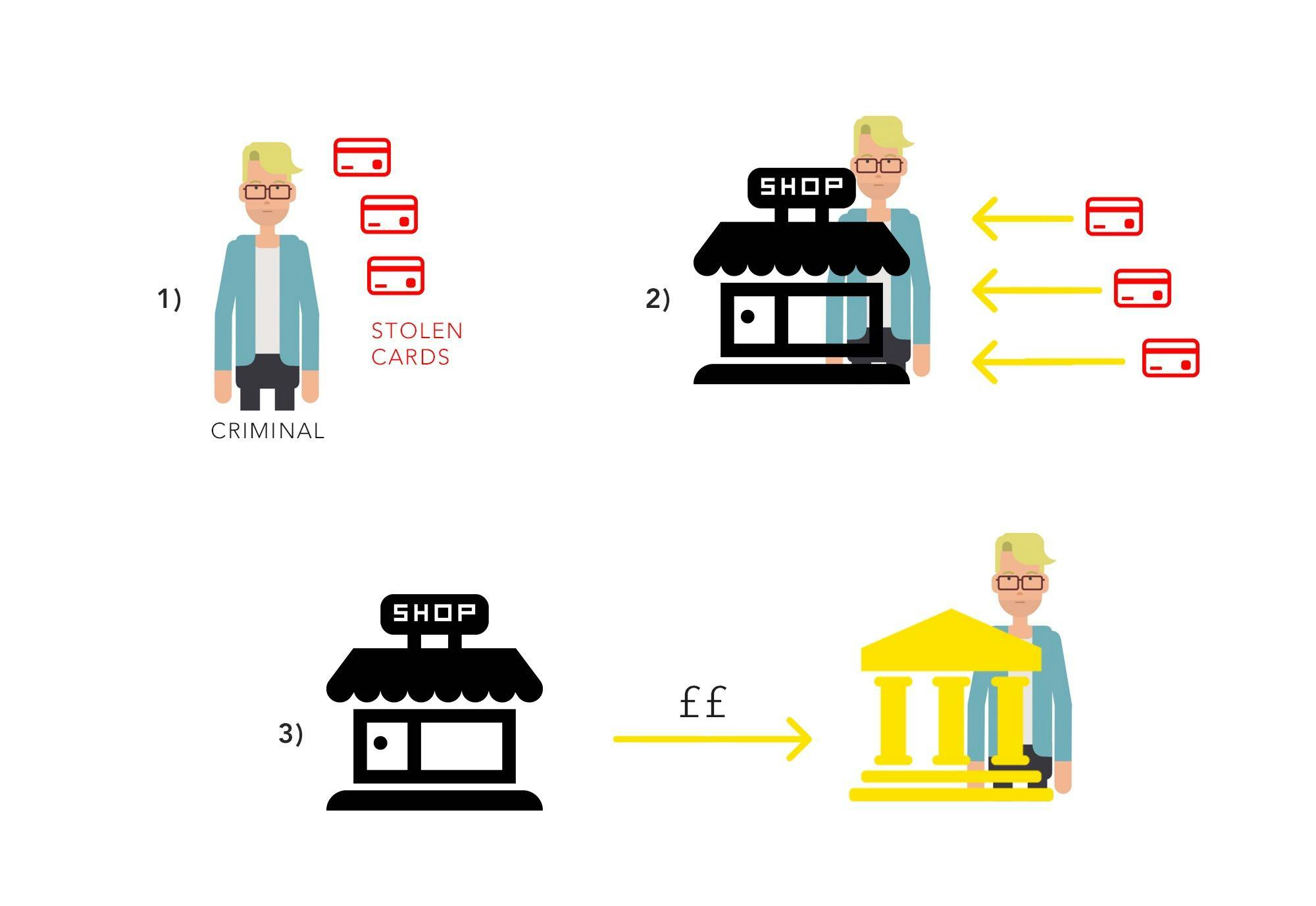

One of the most common examples of buyer-seller collusion occurs when a criminal illegally obtains credit card information and then uses that information to make fake purchases.

As opposed to transferring money directly to their account (making their illegal activity very easy to track), criminals will set up companies, often on a marketplace, and then use the card information to ‘purchase’ non-existent goods and services. No goods are sent, but the transaction flow appears to be legitimate. Funds are then quickly withdrawn before this can be detected.

As with transaction laundering, marketplaces are attractive for this type of financial crime as it is easy to masquerade the illicit activity as usual marketplace spending. In comparison with a P2P payment service, for example, multiple high values sent to one user from varied accounts (perhaps with no geographical link) would raise suspicion.

However, for a marketplace, this is expected activity. Not only is it easier to mask the activity, but typically merchants on marketplaces have higher receiving limits than users on a transfer service—due to the nature of their use case. This can allow for greater amounts to be fraudulently taken and withdrawn before the activity is detected.

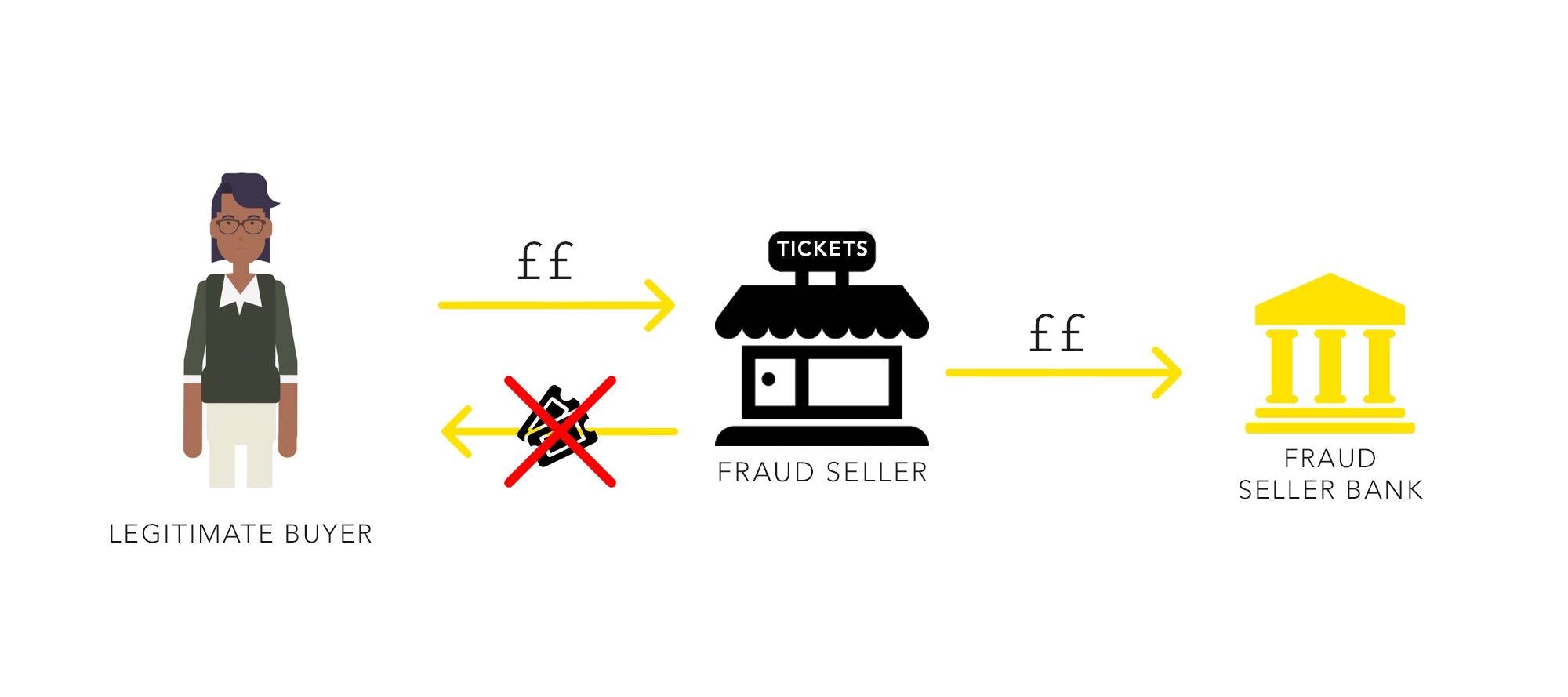

Advanced fee fraud is a more basic and direct form of financial crime. It is arguably more commonplace, but undoubtedly less sophisticated.

At its most blunt, advanced fee fraud can simply be a criminal taking money from an item on a marketplace which either does not exist or is not sent. If the marketplace has no buyer protection in place, there is little that can be done to combat this as it is one user’s word against another’s. A review system can help, but if the seller does not have any previous reviews, the buyer must put blind faith in them.

A more nuanced form of advanced fee fraud occurs when part of the payment is requested before the full transaction has taken place. An example of this may be when a criminal offers tickets on a marketplace and requests part of the fee in order to reserve the tickets or to cover a booking fee. Again, this act is fraudulent, and the good/service is never received.

It is unrealistic to attempt to prevent each and every instance of financial crime from occurring on your marketplace. After all, there is no such thing as complete security.

However, there are positive steps that can be taken to dramatically reduce the opportunities for financial crime. It is important to note that this is the responsibility of your marketplace payment service provider. So, keep the following in mind when choosing which company to partner with. Also, taking additional steps to ensure user data protection, such as identity verification at critical moments or enabling two-factor authentication, are good ways to mitigate risks.

The level in which data—transactional and otherwise—can be monitored and automatically acted upon has developed substantially in recent years. Your payment service provider can alert you when any event occurs that is outside of your marketplace business's usual activity.

This event may be, for example, an unusual spike in activity. When a criminal is attempting to benefit from buyer-seller collusion, they are likely to make as many fake purchases as they can in a short amount of time. So, if one user has >£X of transactions within the first 48 hours of creating an account, you can be alerted immediately and withdrawals could be halted automatically.

Alternatively, you can be alerted if the same bank information is added to multiple accounts. This may suggest that a criminal attempting to benefit from transaction laundering is creating duplicate seller accounts to avoid suspicion surrounding their ‘sales’. Again, transactions related to these accounts could be instantaneously paused, giving an employee of your marketplace time to check if the seller’s account is showing signs of suspicious activity.

These are effective methods in curbing the efforts of fraudulent users and can instill a high level of confidence in your marketplace.

Escrow services allow payments to be ‘held’ until both parties involved are content with the outcome of a given event.

Marketplaces are one of the most obvious use cases for escrow, as it allows for payment to only be received once an item or service has been delivered in the expected condition. This effectively nullifies advanced fee fraud as criminals will know that they will not receive any money if the customer is unhappy with the outcome of the sale.

Escrow is a highly useful tool for any marketplace that instills huge levels of confidence for both sellers and buyers. Whilst buyer protection has proved to be a decent way of fighting fraud, it can only go so far. Customers will always have doubts over how easy it will be to get their money back if they are victims of fraud and how long the process will take. Escrow provides the comfort that should an item not be received, or not received as expected, it can be reclaimed more or less instantly. Many expect escrow to become a standard feature of all marketplaces in the near future.

For many marketplaces, partnering with a payment service provider that is operationally agile is the best way to prevent financial crime.

Operational agility allows for necessary operational processes to be performed in a more flexible manner. An example of this may be performing a stronger level of Due Diligence on sellers as they begin to receive higher and higher values. Across all areas of financial crime, this enables you to match the level of Due Diligence you provide to the level of risk associated to a seller—keeping your platform safe without negatively impacting user experience.

As with the advanced transaction monitoring, the key aspect here is that this approach to Due Diligence can be configured to reflect what is relevant to your business. These ‘tiers’ can be established to represent values that are common for your marketplace and, with the assistance of your payment service provider, modified as you grow.

Financial crime should not be a source of fear for marketplaces. Ultimately, the responsibility will rest with your marketplace payment provider.

However, it can have a big effect on your business both reputationally and financially speaking. Considering the current saturation of the marketplace industry, marketplaces that are seen as unsafe or, worse, harbingers of criminals, are going to find it very difficult to succeed. Furthermore, those needing to deal with regular chargebacks will find themselves with a sizeable bill to foot.

The positive is that whilst issues exist, so do solutions. Developments have been made in payments in recent years, and marketplaces should expect more from what their payment service provider can do. Offering a more accurate and thorough level of financial crime prevention than has ever before been possible may be a marketplace’s best asset in differentiating itself from competitors.

You might also like...

Marketplace software: How to compare and choose the best solution

There are dozens of online marketplace software alternatives to choose from. Learn how to make the right choice for your marketplace idea.

How to design your marketplace transaction flow

The science behind minimal abandoned carts for marketplace platforms.

DAC7: What the new EU tax directive means for online marketplaces

The tax directive DAC7 extends EU tax transparency rules to online marketplaces and requires reporting seller data to tax authorities. In this article, we share what DAC7 is about and how it affects online marketplaces.

Start your 14-day free trial

Create a marketplace today!

- Launch quickly, without coding

- Extend infinitely

- Scale to any size

No credit card required