Automatic off-session payments in the transaction process

In a typical transaction, the customer pays upfront, but the money is held until the transaction completes (e.g. until the booking end date) before it is paid out to the provider’s bank account. Normally, the maximum amount of time the money can be held when using Stripe payments is 90 days. Therefore, the maximum amount of time customers can book in advance is limited, if your transaction process follows this payment pattern.

Sharetribe API has capabilities for saving payment card details for future use . In addition, it is possible to configure your transaction process in such a way that the customer is charged automatically off-session at a certain point in time (i.e. when they are not present and interacting with your web site or app), provided that they have saved a payment card to their account. This allows you to charge customers closer to their booking dates, so that the money can be held in Stripe throughout the booking period.

Another way to use the off-session payment logic might be to create a pre-order functionality for a product marketplace. In a pre-order transaction flow, the provider could put their future offerings for sale and include a delivery date well into the future. Customers could then pre-order the items, and their card would only be charged once the provider marks the orders as being in progress or shipped. Again, this would allow the pre-order time to be longer than the Stripe limitation of 90 days.

Transaction process example

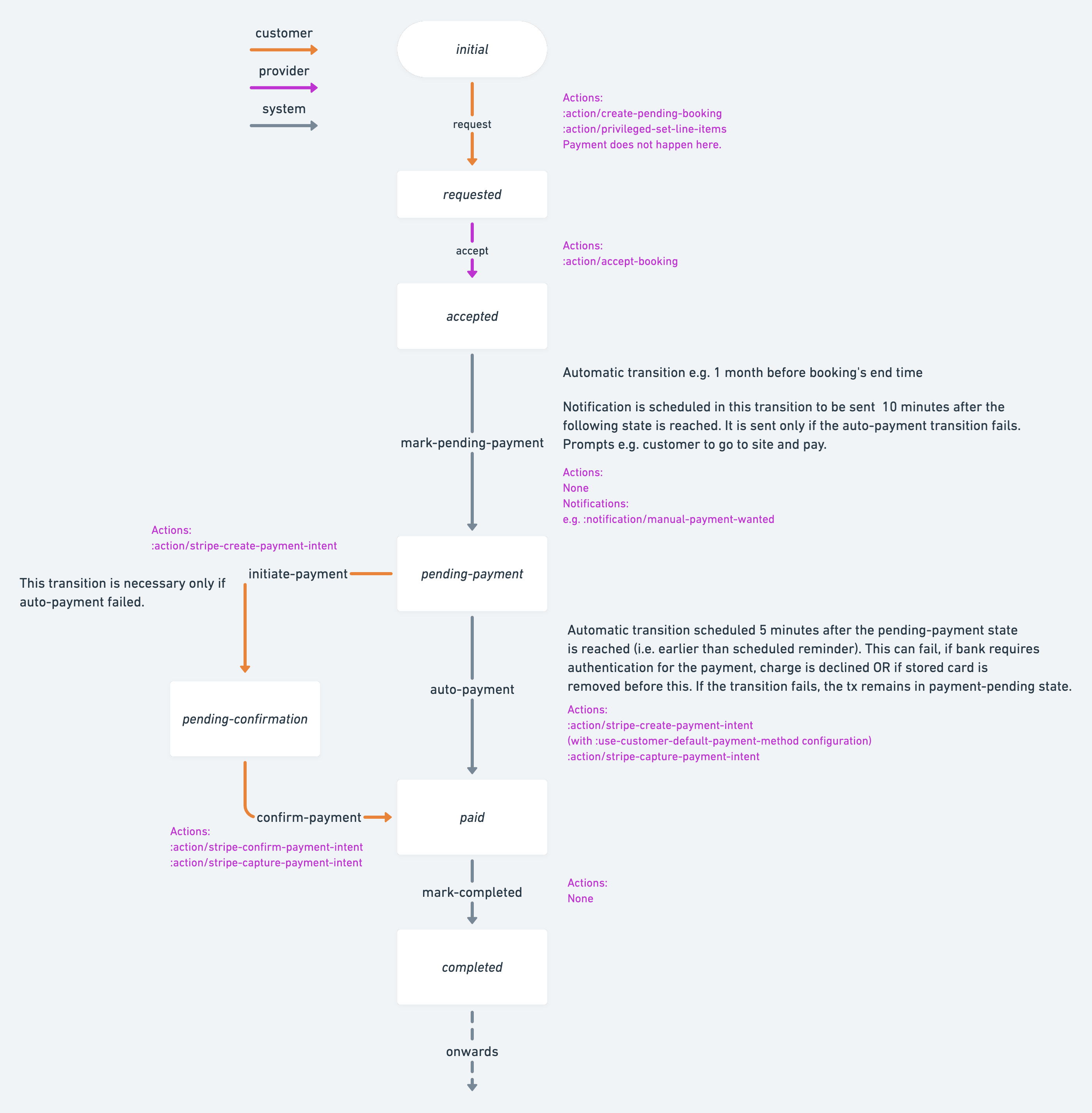

Suppose your sauna rentals marketplace should allow customers to book saunas up to a year in advance, but the customer is only charged at a specified moment before the booking. The figure below illustrates how a part of your transaction process might look like. The example-processes Github repository contains an example transaction process corresponding to the flow described.

In this example, a transaction goes as follows:

- The customer picks the desired booking dates and initiates a transaction. The price of the transaction is calculated, but no preauthorization or payment is made at this point.

- The provider verifies the request and accepts the booking.

- At a later point in time (1 month before the booking start time in this example, and 1 day before the booking start in the example process ), an attempt is made to automatically charge the customer’s stored payment card. If the charge succeeds, the transaction continues onwards.

- The automatic charge can fail for multiple reasons. If the charge fails, the customer (and optionally also the provider) receives an email notification and the customer is asked to visit the marketplace website in order to pay manually.

How does creating and capturing an off-session payment work?

In the auto-payment transition, the payment intent creation needs to be configured to use the customer’s saved payment information, if it exists. When the action is configured like this, it both creates and confirms the payment intent. Therefore, only capturing the payment intent remains necessary.

{:name :transition/auto-payment,

:from :state/pending-payment,

:to :state/paid,

:at

{:fn/plus

[{:fn/timepoint [:time/first-entered-state :state/pending-payment]}

{:fn/period ["PT5M"]}]},

:actions

[{:name :action/stripe-create-payment-intent,

:config { :use-customer-default-payment-method? :true }}

{:name :action/stripe-capture-payment-intent}]}It is important to note that an off-session payment can fail for various reasons. For instance:

- the card could be denied due to insufficient funds,

- the issuing bank may require additional authentication from the customer (this can easily occur with European payment cards with Strong Customer Authentication regulation)

- or the payment card might have expired.

It is therefore always important to allow for a fallback payment path in your transaction process. In Sharetribe, only one transition from a state can be triggered automatically, so a fallback payment path must trigger upon a user action, as in the example.

You can build upon this example and extend it to make the payment process more robust. For instance, in case the customer fails to pay for the transaction within certain amount of time, you may wish to allow the provider or marketplace operator to cancel the transaction, or allow the provider to post a review of the customer. In addition, you may consider disallowing customers to remove their stored payment card in your UI implementation, if they have ongoing transactions for which they have not yet been charged.

Considerations about implementation in Sharetribe Web Template

If you want to implement the example process in your user interface, there are multiple ways to do so. If your user interface is based on the Sharetribe Web Template, here are a few things worth considering.

Transitions and states

Transitions and states are used in the template as conditions for several behaviors, including redirects and displayed content. The transaction resource contains information about the transaction’s last transition and its timestamp.

Separating order from payment

In the default transaction process and default template flow, the order

is initiated and processed in

CheckoutPageWithPayment.js

using processCheckoutWithPayment().

ListingPage.shared.js passes initial values

in its handleSubmit() with callSetInitialValues(), and those initial

values get handled on the checkout page. Since the off-session payment

process separates initiating the order (i.e. creating a booking, setting

line items in a privileged transition) from payment (creating and

further processing Stripe payment intent), it is important to pay

attention to the way you want to handle that separation.

- What happens when user clicks ‘Request to book’ on ListingPage.js?

- Where is the API call made to invoke the initial process transition that creates a booking and sets line items?

Handling delayed manual payment

If the automatic payment succeeds, the customer does not need to take

further action on the transaction before the review process. Manual

payment, on the other hand, does require a new user flow in the

template.

CheckoutPage.js

is set up to handle payments toward Stripe, so the simplest option is

that after an automatic payment has not succeeded and the customer has

manually triggered the transition to create a payment intent, they are

redirected to CheckoutPage.js (cf.

TransactionPage.js

redirectToCheckoutPageWithInitialValues()) to continue the process.

Pay attention to the following points when designing your user flow:

- What action does the customer take in the UI to initiate manual payment?

- Does the provider see whether or not the customer has paid for the booking?